- Home >

- Services >

- Access to Knowledge >

- Trend Monitor >

- Source of threat >

- Trend snippet: Data security is one of the main drivers for development of the Dutch fintech scene

Trends in Security Information

The HSD Trendmonitor is designed to provide access to relevant content on various subjects in the safety and security domain, to identify relevant developments and to connect knowledge and organisations. The safety and security domain encompasses a vast number of subjects. Four relevant taxonomies (type of threat or opportunity, victim, source of threat and domain of application) have been constructed in order to visualize all of these subjects. The taxonomies and related category descriptions have been carefully composed according to other taxonomies, European and international standards and our own expertise.

In order to identify safety and security related trends, relevant reports and HSD news articles are continuously scanned, analysed and classified by hand according to the four taxonomies. This results in a wide array of observations, which we call ‘Trend Snippets’. Multiple Trend Snippets combined can provide insights into safety and security trends. The size of the circles shows the relative weight of the topic, the filters can be used to further select the most relevant content for you. If you have an addition, question or remark, drop us a line at info@securitydelta.nl.

visible on larger screens only

Please expand your browser window.

Or enjoy this interactive application on your desktop or laptop.

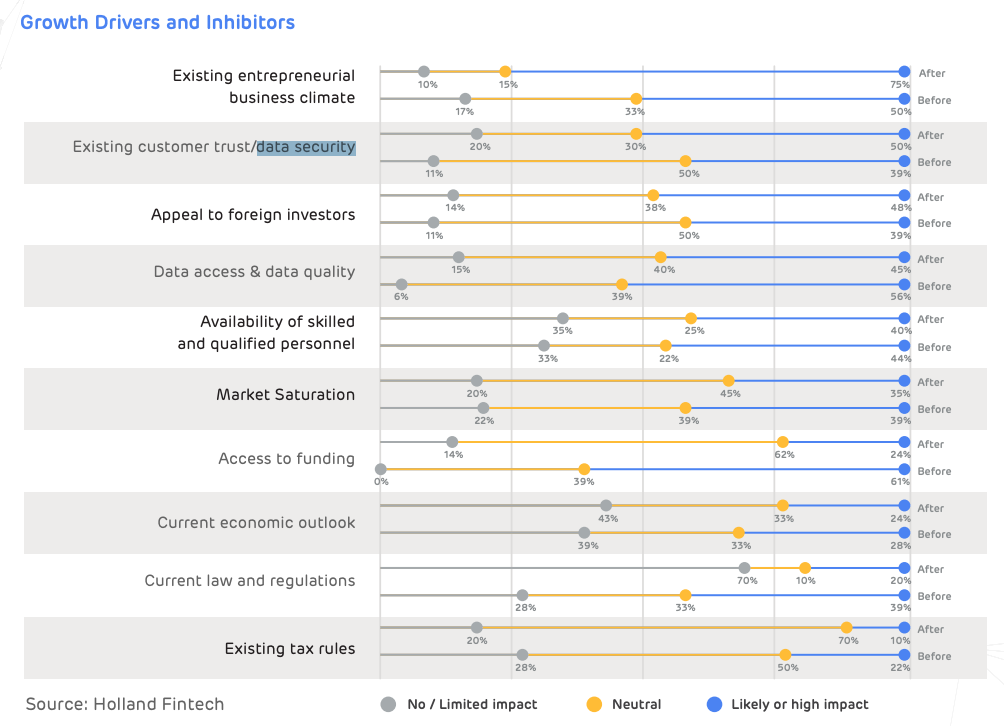

Data security is one of the main drivers for development of the Dutch fintech scene

Access to funding, data access & data quality as well as the entrepreneurial business climate were considered drivers for the Dutch fintech scene, the COVID-19 virus has shifted that completely to the entrepreneurial business climate. Respondents indicate that they expect this to be an important driver for growth post-lockdown. This is followed – though with some distance, by existing customer trust & data quality, assuming that respondents see the developments in open banking and the associated regulation as well as the increase of attention on data security as a driver for customer trust. At the moment, fairly similar to before the lockdown, the existing tax rules as well as law & regulations are considered to be most important inhibitors. And despite governmental efforts to support and stimulate entrepreneurs, 70% of the respondents state that the current law and regulations will have no or hardly any influence on growth. The biggest shift can be seen in access to funding, where before the lockdown 61% expected this to be a driver for growth, compared to 24% post lockdown.