- Home >

- Services >

- Access to Knowledge >

- Trend Monitor >

- Source of threat >

- Trend snippet: The Dutch market for cloud services continuous to grow

Trends in Security Information

The HSD Trendmonitor is designed to provide access to relevant content on various subjects in the safety and security domain, to identify relevant developments and to connect knowledge and organisations. The safety and security domain encompasses a vast number of subjects. Four relevant taxonomies (type of threat or opportunity, victim, source of threat and domain of application) have been constructed in order to visualize all of these subjects. The taxonomies and related category descriptions have been carefully composed according to other taxonomies, European and international standards and our own expertise.

In order to identify safety and security related trends, relevant reports and HSD news articles are continuously scanned, analysed and classified by hand according to the four taxonomies. This results in a wide array of observations, which we call ‘Trend Snippets’. Multiple Trend Snippets combined can provide insights into safety and security trends. The size of the circles shows the relative weight of the topic, the filters can be used to further select the most relevant content for you. If you have an addition, question or remark, drop us a line at info@securitydelta.nl.

visible on larger screens only

Please expand your browser window.

Or enjoy this interactive application on your desktop or laptop.

The Dutch market for cloud services continuous to grow

relatively high. At the same time, the uptake of cloud services in this industry has been relatively slow, due to concerns on compliance, security and privacy.

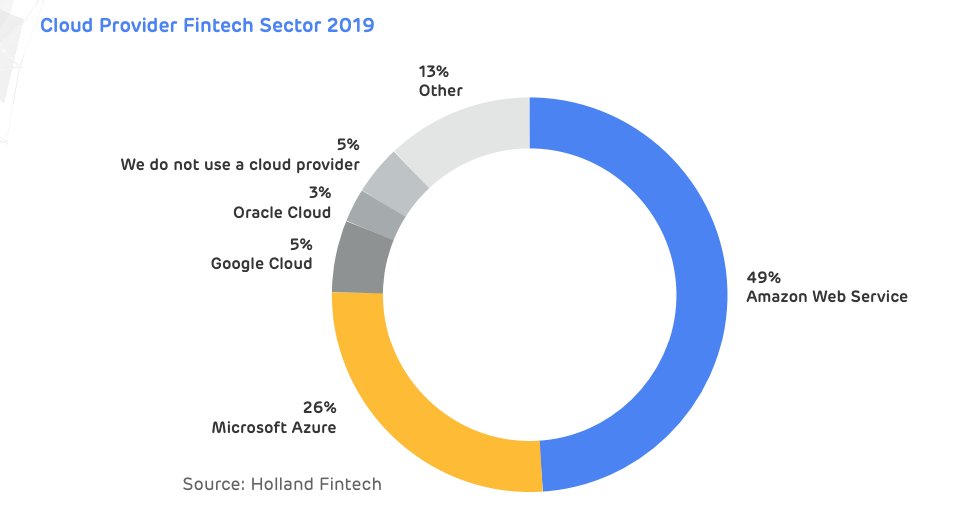

The Dutch market for cloud services continuous to grow, especially cloud-based services in the area of application hosting, web hosting, server platforms, as well as storage, backup, security and workplace automation is growing fast in the Netherlands. Leading vendors are Amazon Web Services (AWS), Microsoft and Google. Cloud market share in the fintech industry, does not differ much from general market shares. Amazon is the main cloud provider among the respondents, followed closely by Microsoft. Overall, the financial services industry is highly digitized, and therefore technology adoption rates are relatively high. At the same time, the uptake of cloud services in this industry has been relatively slow, due to concerns on compliance, security and privacy. Ultimately though, the advantages of cloud computing like cost effectiveness, interoperability, scalability, reliability and flexibility are considerable and weigh heavily against concerns in the areas of compliance and industry regulations. Where the more recent fintech companies are generally cloud native, we now see the more traditional FSPs also shifting to cloud models. The emergence of new banking models combined with digital transformation initiatives and the emergence of new digital players requires a more flexible and scalable IT structure. Where incumbents have traditionally continued to invest in legacy systems, they are now at the tipping point to rethink their technology infrastructure to facilitate digital transformation. This does not necessarily mean an all-or-nothing approach to a cloud infrastructure, but a gradual move is taking place. Especially in the front office area, where customer service and the customer journey are clear distinctive competitive forces and a cloud infrastructure offers substantial benefits this transition is progressing quickly.