Keen Venture Partners Announces First Close of European DefenceTech Fund

Keen Venture Partners has reached a major milestone by completing the first close of its European Defence & Security Technology Fund, securing over €150 million making it the largest dedicated defence-tech VC fund in Europe.

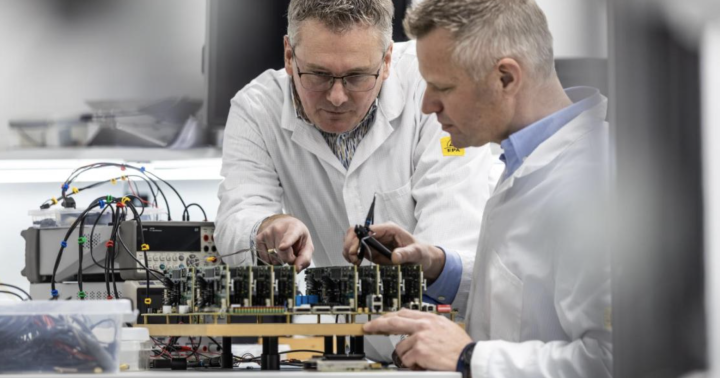

With the fund fully operational, Keen is now actively deploying capital into startups and scale-ups across European NATO countries that are developing advanced defence and security technologies.

Strengthening Europe’s Strategic Autonomy

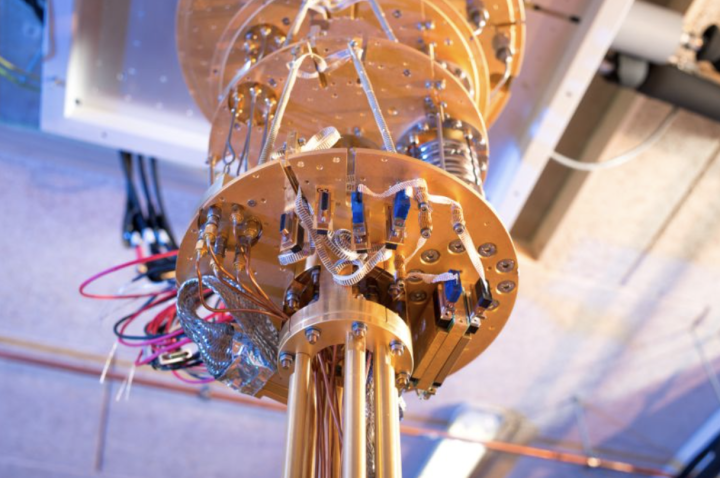

This launch comes amid a pressing need for Europe to strengthen its strategic independence in defence. The ongoing global tensions have underscored how critical software-driven innovations such as AI and autonomous systems are becoming on the modern battlefield. Yet many European innovators still face barriers when it comes to accessing both capital and initial defence customers.

Strong Institutional Support

The fund’s first close was made possible thanks to significant contributions from both private and institutional investors, including major European investment and pension funds, as well as support from research organizations and the financial sector.

Where the Money Will Go

Keen’s fund has a clear investment strategy focused on:

-

Cybersecurity, autonomous systems, deterrence technologies, and space applications

-

Investing in more than 25 companies, from seed to Series B stages, with a focus on Series A

-

Investment tickets typically ranging from €1 to €10 million per company

-

Portfolio companies include those developing advanced AI solutions, autonomous systems, and cybersecurity platforms

A Call to Ambitious Founders

Keen is looking to partner with visionary entrepreneurs: “If you’re building technology that can make a real difference on tomorrow’s battlefield or that can boost Europe’s resilience we want to hear from you.”

To support future growth, Keen is expanding its team, hiring additional investment professionals, and planning strategic collaborations and co‑investments with other European VC firms.