TIIN Capital Launches European Cyber Tech Fund V

TIIN Capital announced the first closing of its fifth Tech Fund, European Cyber Tech Fund V. This fund, with a targeted size of € 100 million, is strategically positioned to invest in European cybersecurity scale-ups. As a leading Dutch venture capital firm, TIIN Capital is committed to supporting the international growth and expansion of European cybersecurity enterprises, with the overarching objective of developing and rolling out 'made in Europe' cybersecurity solutions and products.

The first closing generated interest from single family offices and successful entrepreneurs, including Dutch cybersecurity entrepreneurs Ronald Prins and Menno van der Marel, co-founders of Fox-IT, a prominent global player in the field of cybersecurity. The final closing of the fund is scheduled for the first half of 2024.

Expressing gratitude for the support, Michael Lucassen, Managing Partner at TIIN Capital, stated, "We are pleased that the group of investors who joined the first closing is fully committed to our strategy and our way of working. It is of great significance for us that loyal investors from previous funds as well as new fund investors showed their confidence by participating in the fund.”

The European Cyber Tech Fund V has already marked its position in Europe with an investment in a rapidly growing company in the Netherlands. This company is specialised in delivering an AI-powered intelligence platform (OSINT) to governments and organisations worldwide for national and economic security. This initial investment underscores the fund’s ambition for the short term, with plans to invest in approximately twelve promising and upscaling European cybersecurity companies in the coming years.

Reinout vander Meûlen, Partner at TIIN Capital, emphasised the firm’s added value by supporting cybersecurity companies in becoming market leaders. “We are focused on building a strong and cybersecure Europe, with the best 'made in Europe' cybersecurity solutions, with ambitious and balanced teams, who will benefit from our experience in scaling internationally, our network and expertise.”

Established in 1998, TIIN Capital has evolved last years into a leading venture capital investor in European cybersecurity. In 2018, the firm strategically shifted its investment focus from 'general tech' to 'cyber tech' by launching the Dutch Security TechFund. TIIN Capital’s network of cybersecurity specialists, including Chief Information Security Officers (CISOs), IT security professionals, corporates, governments and highly successful entrepreneurs, has expanded across Europe. This European network not only supports fund management by facilitating the exchange of knowledge, scaling experiences and networks, but also benefits portfolio companies.

TIIN Capital takes pride in its role as a principal European cybersecurity scale-up investor, collaborating across multiple European countries in lead or co-lead investor roles with other European investors. Examples of its successful investment approach include portfolio companies such as Eye Security, EcleticIQ, BreachLock, EGERIE, Probely, Syntho.ai and Sygno. The Dutch Security Tech Fund, the predecessor fund of European Cyber Tech Fund V, invested in eighteen cybersecurity companies and successfully exited four companies in the previous period.

Source: TIIN Capital

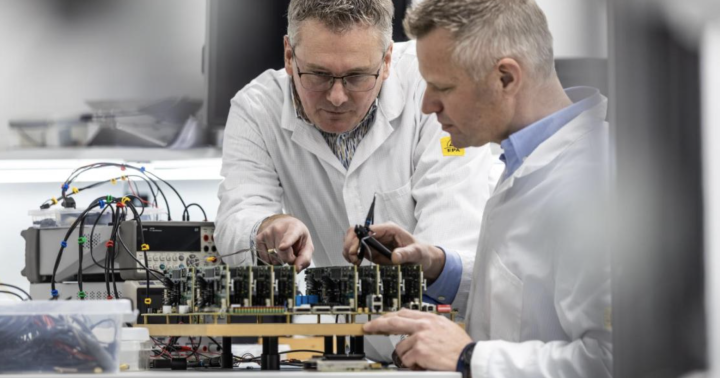

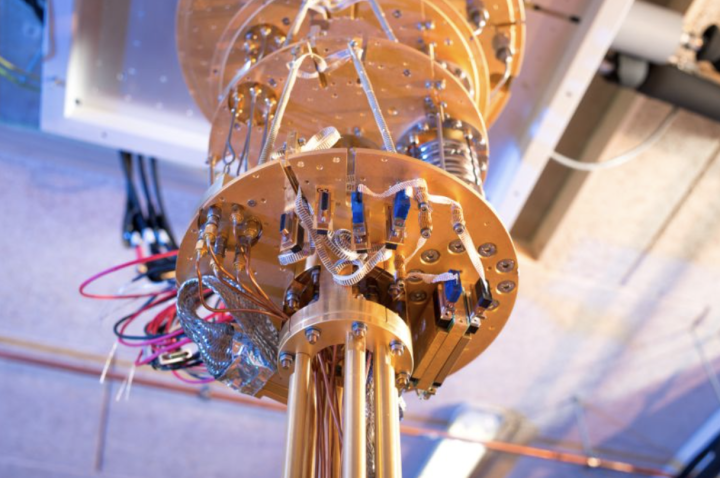

Photo: Istock.com/Sakorn Sukkasemsakorn